Daily News: Multiple Positive fFactors Have Contributed To The Recent Rise In International Oil Prices

Pub Date:Oct 16,2020 | Views:956 |

Multiple Positive fFactors Have Contributed To The Recent Rise In International Oil Prices

WTI and Brent crude futures rose 2.09% and 2.05% from the previous day to $41.04 and $43.32 respectively on Oct. 14.

Since the beginning of October, international oil prices have risen as a whole due to positive factors such as China's economy, Opec + 's compliance with the production reduction agreement, the impact of hurricane Delta on oil production capacity in the Gulf of Mexico of the United States, and the decline in inventories.

Data released by the General Administration of Customs on October 13 showed that China's total import and export volume in September reached 3.066 trillion yuan, up by 10% year-on-year. In the first nine months of this year, the total import and export volume reached 23.115 trillion yuan, up by 0.7% year-on-year, demonstrating the strong momentum of China's economy. WTI and Brent reversed course to gain 1.95 per cent and 1.75 per cent, respectively, from the previous day. Sources said that the implementation rate of Opec + production cuts is expected to reach 102% in September, which shows the efforts of Opec + to promote oil price recovery. In Norway, oil and gas production fell by more than 330,000 b/d, or about 8% of total output, as strikes by oil workers shut down six of the country's offshore fields. In the US, 91 per cent of oil production platforms and 62.2 per cent of natural gas production in the Gulf of Mexico were shut down after Hurricane Delta made landfall on the largest scale in 15 years. Crude oil inventories in the United States fell 5.421 million barrels to 495.4 million barrels in the week to October 9 from the previous week, according to data released by the American Petroleum Institute on October 15, a decline that provided some support to international oil prices.

At the same time, the bearish factors do not support a sharp rise in oil prices. In the past two weeks, confirmed coVID-19 cases have been on the rise in North America, Europe and other places. The spread of coVID-19 has undermined market expectations of economic recovery, and the slow progress of a new fiscal stimulus agreement in the United States has put pressure on oil prices. The Sharara field, Libya's largest, and the strong willingness of U.S. producers to resume production are also weighing on prices.

The extent of the COVID-19 outbreak, the outcome of the US election and the next steps taken by Opec + will be important factors influencing oil prices as short-term support for oil prices dissipates.

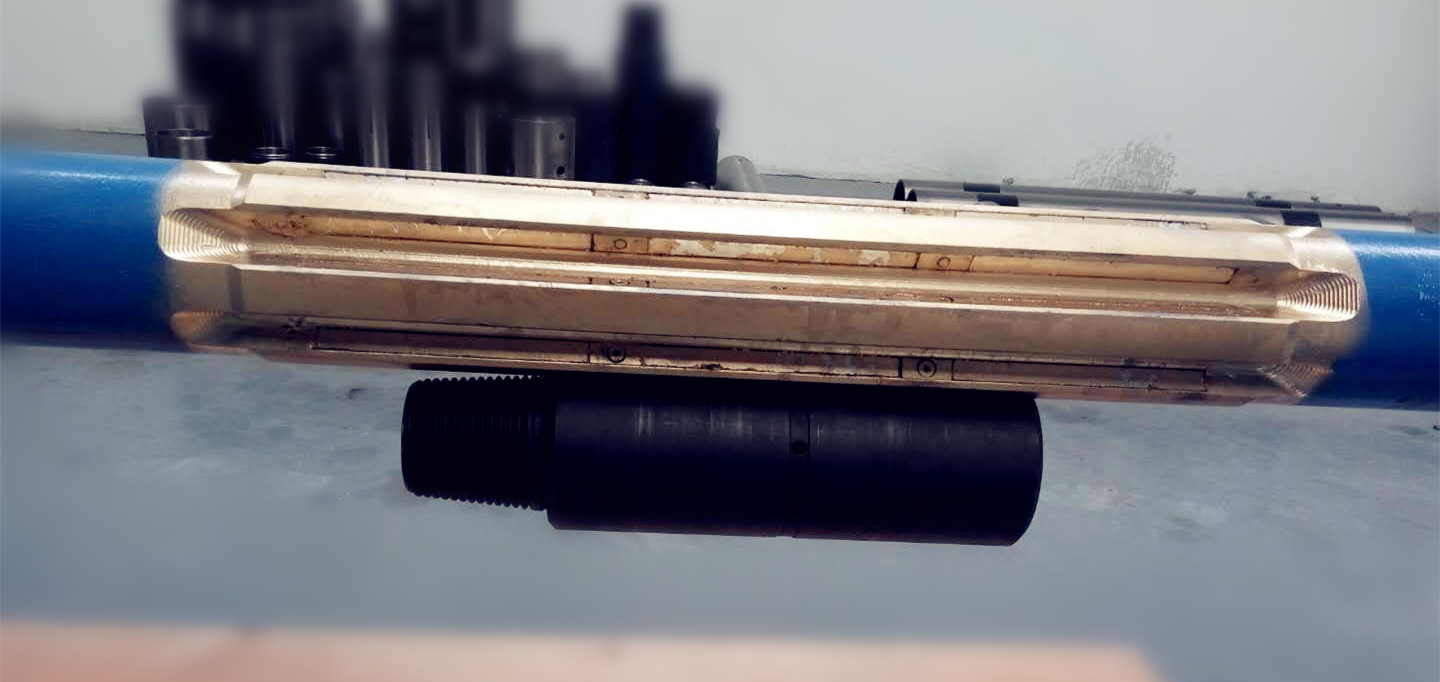

Daily Recommendation: Wellbore CleanOut Tools(Casing Scraper, Casing Brush, String Magnet)

Contact: jerry@kwoil.cn; linda@kwoil.cn,

WhatsApp/ Tel: +86 151 0293 5475