AFP reported, local time on November 3, the world's largest oil producer, Saudi Arabia's state oil company (Saudi aramco), according to the earnings release because of COVID - 19 outbreak seriously affect the global demand for crude oil, to crack down on oil prices, the company in the third quarter net profit of $11.8 billion, compared with $21.3 billion during the same period last year net profit fell 45%.

Aramco said its third-quarter sales fell 25 per cent to $53.5bn as a slump in demand for energy and refining dented margins on refining and chemicals.

While net profit plunged in the third quarter from a year earlier, the decline has slowed and stopped four consecutive quarterly profit declines, with the first quarter-on-quarter increase in five quarters. In the first half of this year, Aramco's net profit was $23.2 billion, down 50.5% from $46.9 billion in the same period last year. In the second quarter, Aramco's net profit was just $6.6 billion, down from less than 60% in the third quarter and down 73% from $24.7 billion a year earlier.

Amin Nasser, President and CEO of Saudi Aramco, said: "Despite the headwinds facing the global energy market, we saw the first signs of recovery in the third quarter due to improved economic activity. In the face of market volatility, we will continue to adopt a disciplined and flexible approach to capital allocation. We are confident that Aramco will be able to weather these challenging times and achieve our goals."

Notably, Aramco generated only $12.4 billion in cash flow in the third quarter, but the company said it would keep its $18.75 billion third-quarter dividend unchanged and didn't say how it would make up the shortfall.

Tarik Fadela, chief executive of Nomura Asset Management's Middle East division, said: "Aramco is now paying a lot more dividends than it earns. That will not be a problem if oil prices rebound next year. But if the oil price plummets, that will be a big problem for the company." With weaker oil prices and flat production, Aramco may have to continue to fund its hefty dividend through "short-term borrowing", according to Bernstein research.

According to foreign media, aramco's dividend is the main source of cash for the Saudi government, which is expected to widen its budget deficit to 12% of GDP by 2020 due to the severe economic contraction caused by the epidemic.

Saudi Arabia is moving forward with its "Vision 2030" economic reform plan aimed at diversifying the country's economy away from oil. Analysts cautioned that the reform plan would still depend on oil revenues, and that the current decline in oil revenues could hamper its progress.

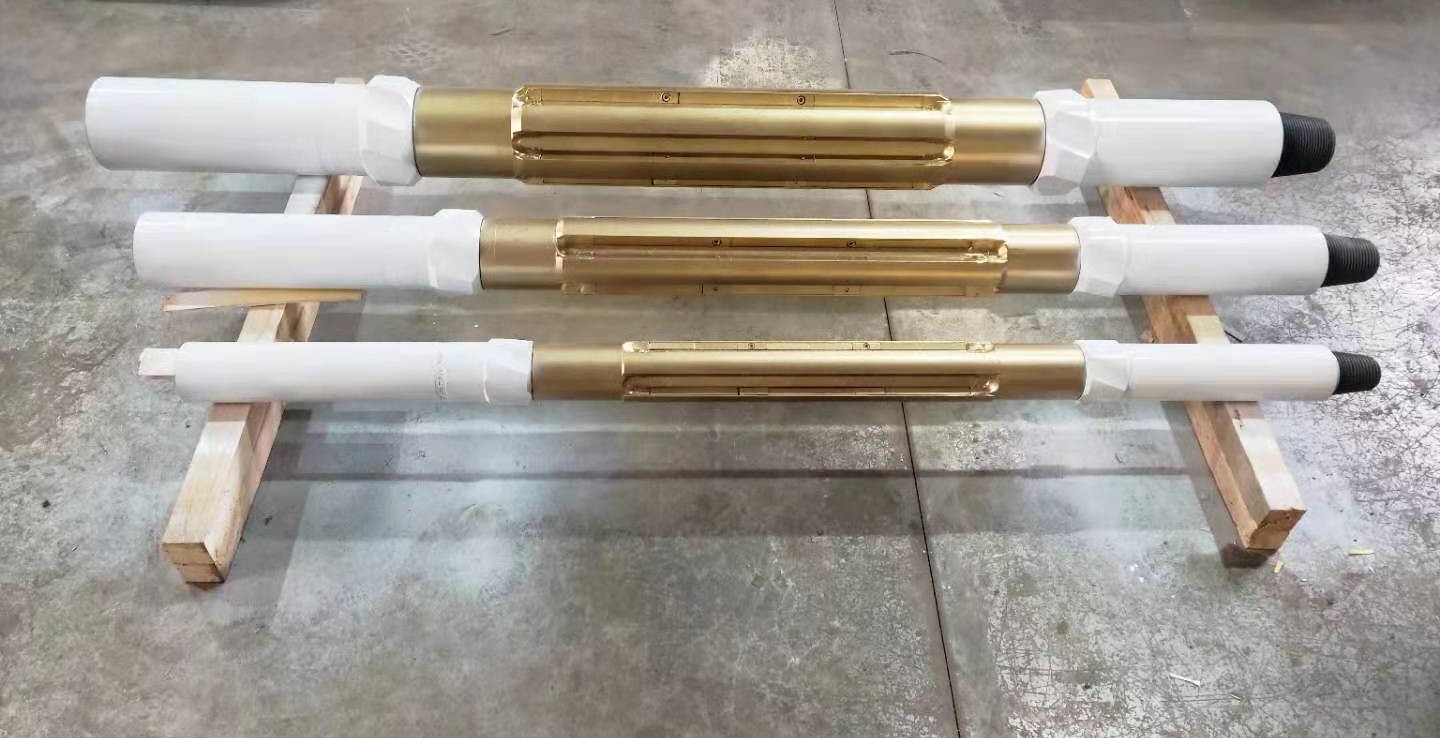

Daily Recommendation: Wellbore CleanOut Tools(Casing Scraper, Casing Brush,

String Magnet)

Contact: jerry@kwoil.cn; linda@kwoil.cn,

WhatsApp/ Tel: +86 151 0293 5475