A sharp drop in U.S. investment in fixed assets

Sinopec News Network, May 18,2020 Analysts at the dallas federal reserve bank (Dallas Fed) said in a new analysis this week that sharp spending cuts across the u.s. shale sector could lead to a 6.1 percentage point drop in fixed investment in u.s. companies in the second quarter as a result of depressed oil prices.

Over the past decade, investment in the oil and gas industry has increased as a proportion of total fixed investment by non-residential firms in the United States as a result of the shale gas boom. In the 2010s, U.S. oil companies spent a total of $1.2 trillion on drilling and completion, boosting U.S. crude production by nearly 140% over the past decade. The Dallas Federal Reserve Bank points out that the oil and gas sector accounts for an average 6.4 per cent of fixed investment in non-residential businesses in the United States, double the share of the past decade. Fixed investment is an important part of American GDP.

Even before the collapse in oil prices in early March, some U.S. oil companies had begun to reduce their planned 2020 investments by 10 to 20 per cent, abandoning the strategy of "yield growth at all costs" because investors demanded returns and profits.

But after a slump in demand caused by the outbreak and a multi-year low caused by the Saudi oil price war, US shale-gas fields quickly withdrew investment and drilling.

With plummeting oil prices, a glut of global oil supplies and a lack of reserve space, a daily cut in U.S. oil companies has been announced.

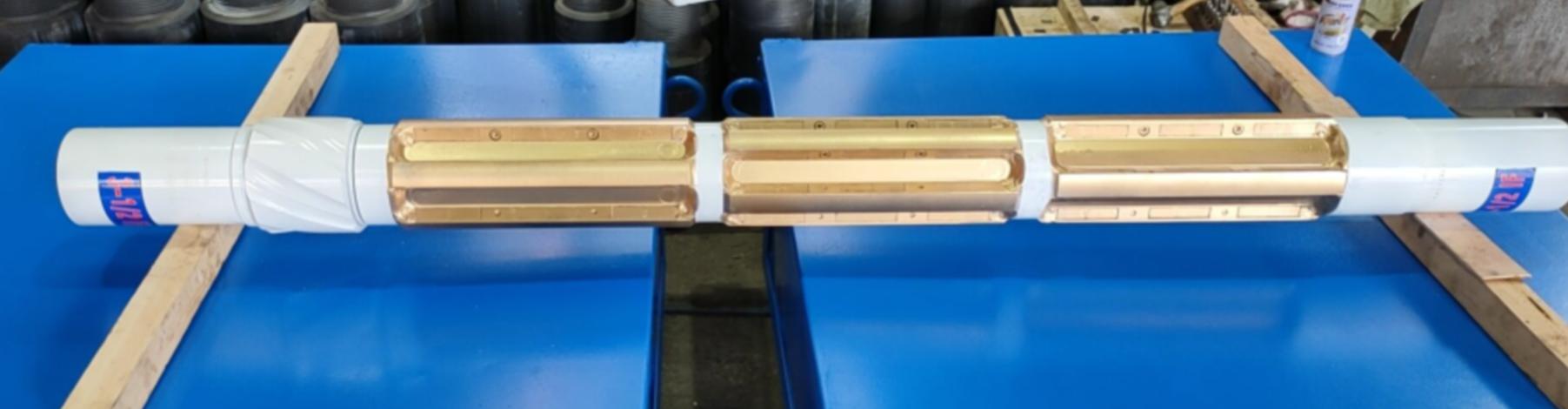

Casing Cleaning Tools MULTIBACk (MBACK) Heavy-Duty RAzOR BACk (HDRB) RAzOR BACk (RB)

Daily Recommendation: Wellbore CleanOut Tools---KING-STAR MAG String Magnet

Halliburton Baker Hughes Odfjell Drill

Contact person: Linda; sales@kingwelloilfield.com Tel: +86 133 7918 7081

SWITCHBACk (SWB) WELL COMMANDER